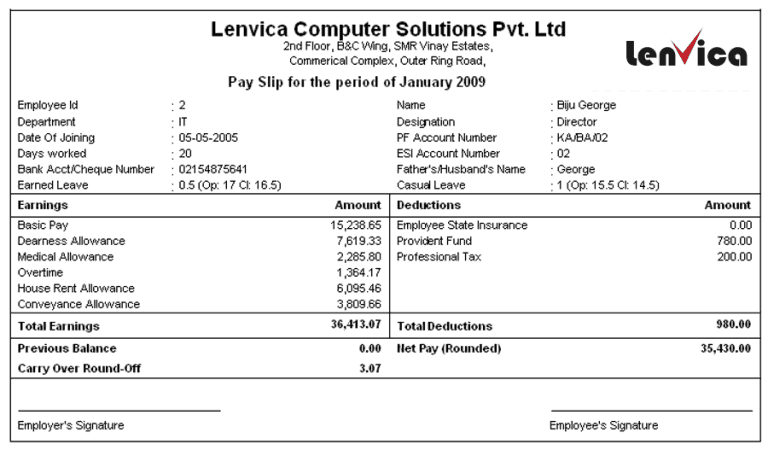

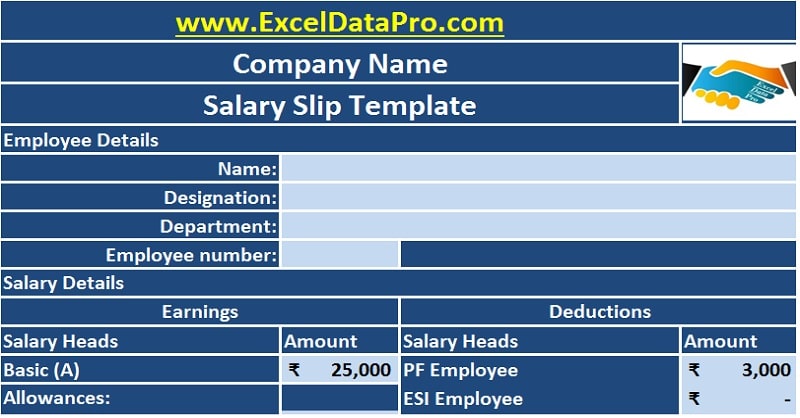

In the second step of making a salary slip format in Excel, we will insert employee details. Then, type the company name as the header of that Excel file in cell B4.In the first step, we will add the header in our tally salary slip format in Excel. STEP 1: Add Company Name in Header Section of Slip Format So, without further delay let’s see the steps to create a salary slip format. Throughout this article, we will create this template by following some simple steps. In the following image, we can see a template of tally salary slip format in Excel. You can reduce TDS by investing in tax-saving schemes and submitting the appropriate documents to your employer.Step-by-Step Procedures to Create Tally Salary Slip Format in Excel It refers to the amount of tax deducted by your employer on behalf of Income Tax department. It is levied in some states only and calculated on the basis of an individual's tax slab. This payslip component is levied on all individuals, including the salaried, professionals and traders who have an income. This component of your salary slip is at least 12% of your basic salary and diverted to an EPF account and is exempt from tax. This comprises a compulsory deduction in your salary slip.

An employer may categorize such allowances under a specific head or group them as 'Other Allowances' This comprises the various additional allowances paid by an employer for any reason. This is given to encourage employees for a better performance. You can claim a part of the HRA as a tax deduction, and need to be declared while ITR filing.

The amount of HRA depends on the location and ranges between 40%-50% of basic pay. It is an allowance to help people pay their house rent. This payslip component is typically only for government employees. It is completely taxable and need to be declared while ITR filing.

For eg: 12% of the basic pay is usually the PF.Ĭalculated as a percentage of your basic pay, DA is given to offset the impact of inflation. This is the primary component of your employee's salary and also acts as the foundation upon which other components are calculated.

0 kommentar(er)

0 kommentar(er)